CPM Associates is a brokerage company that specializes in providing expert advice in the field of risk management, auditing and mediation of insurance services for corporate clients operating in the Slovak Republic. The company currently has 15 offices throughout Slovakia with more than 30 advisors who focus on corporate clients.

The main goal is to provide the client with the most optimal coverage of individual risks at the lowest possible costs. CPM Associates works closely with selected insurance companies, often on the basis of individually agreed conditions for a specific client. A personal approach, discretion, high flexibility and professional responsibility for the quality of the services provided and at the same time for the results achieved are a matter of course.

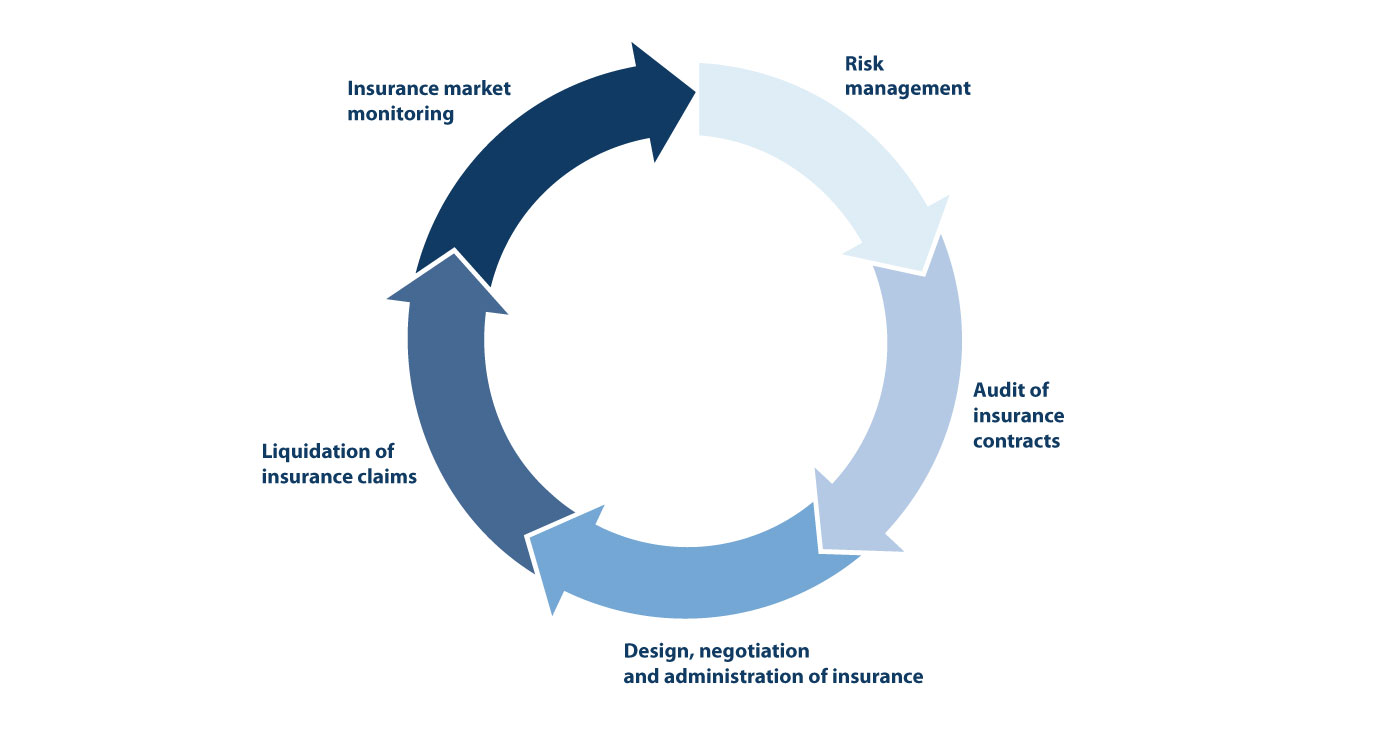

Risk management

We provide our clients with expert advice and consultations in the field of company risk management, the aim of which is to develop comprehensive security and protection against possible.

Audit of insurance contracts

This is an in-depth inspection of the company's existing insurance contracts from the point of view of their meaning and purpose, as well as an assessment of their effectiveness from the point of view of the insured risks to the incurred costs.

Design, negotiation and administration of insurance

Based on the client's goals, the audit of existing insurance contracts and the company's concept of comprehensive security, we approach the selection of insurance companies and products that are adapted to the individual needs and requirements of each client. After negotiating the optimal insurance products, we provide our clients with comprehensive management throughout their duration.

Liquidation of insurance claims

For our clients, we provide expert advice and complete administration related to the liquidation of insurance claims. At the same time, we assume responsibility for fast and adequate performance that is in accordance with the concluded contract, and in the event of any problems, we represent our client until the insurance claim is resolved.

Insurance market monitoring

For our clients, we constantly monitor the development of the insurance market and at the same time analyze new insurance products for the purpose of changes and therefore more effective insurance.

Property insurance

This is a basic type of insurance, the purpose of which is to protect the property of companies, and thus the business activity itself, against financial losses that may arise as a result of its damage or destruction.

Motor vehicle insurance

This is the most widespread type of insurance, which mainly includes mandatory contract insurance (PZP), the conclusion of which is mandatory for the vehicle owner by law, and of course accident insurance (Kasko), which offers insurance for the vehicle in the event of its damage, theft, destruction, or natural event.

Liability insurance

Each company is responsible for the damage it may cause to third parties through its activities, or breach of legal obligations. At the same time, it is not important whether the damage was caused by action, inaction or relationship.

Insurance of financial risks

Financial risk insurance includes important risks that most companies are exposed to in their daily business, and which, if they occur, can cause the company extensive financial losses.

Business interruption insurance

Interruption, or restriction of operation due to material damage to the property used for business activity can also cause large financial losses, which often exceed the material damage to the property itself by several times.

Agricultural insurance

This is a specific type of insurance, the purpose of which is to insure risks associated with plant and animal agricultural production.

Environmental insurance

Environmental protection concerns not only ordinary citizens, but above all large industrial companies and factories, whose activities have a direct impact on the quality of the environment. Companies that may cause environmental damage through their business are required by law to take out liability insurance for environmental damage.

For employees

We can individually adapt our employment programs to each company. The emphasis is mainly on motivation with the highest possible efficiency of the costs incurred.

Financial services

Through long-term experience in the financial market, we also offer our clients solutions in the field of financing their short-term and long-term needs.